💥 TRENDING: Management consultants/valuation - Full Archive

Hire Freelance Valuation Specialists

Julio C. Ortiz

Freelance Valuation Specialist

Verified Expert in Management Consulting

Panama

Toptal Member Since February 18, 2021

Julio has diversified experience as a finance VP for multinationals based in the US and Latin America in the financing, pharmaceutical, luxury goods, and personal care sectors and distribution channels, such as retail, wholesale, and travel retail. Julio's expertise includes financial planning and modeling, investment banking, commercial real estate, fundraising, business plan development, logistics, company valuation, and strategic and visionary leadership based on innovation and creativity.

Show MoreTrevor Davis

Freelance Valuation Specialist

Verified Expert in Management Consulting

Canada

Toptal Member Since February 21, 2019

Trevor is an experienced entrepreneur and banker with a background in business plan development, financial modeling, M&A, capital raising, and business valuation. He has worked and advised clients across many industries. Trevor has worked on over $5 billion of M&A and financing transactions and has advised clients ranging from early-stage startups to multi-billion dollar businesses.

Show MoreBarbara Close

Freelance Valuation Specialist

Verified Expert in Management Consulting

United States

Toptal Member Since August 4, 2022

As a former KPMG and PwC consultant and Fortune 1000 executive, Barbara has collaborated with CXOs to solve operational challenges in diverse industries for 20+ years. She has expertise across consumer and industrial products and services, manufacturing, logistics, eCommerce, retail, and technology, where she uses her engineer's mindset to drive business value, minimize costs and risk, and optimize processes. Barbara is a mechanical engineer and Kellogg MBA.

Show MorePaulius Uziela, CFA

Freelance Valuation Specialist

Verified Expert in Management Consulting

Lithuania

Toptal Member Since October 7, 2019

Paulius has closed 20+ seed/early-stage investments in AI, technology, SaaS, energy, and other sectors. He also has experience working on debt transactions and the biggest regional M&A deals in the Baltics while employed at a leading consulting firm (Deloitte) and DNB bank. Paulius is a CFA charter holder who enjoys freelancing to help clients on valuation, financial modeling, and fundraising projects.

Show MoreOlov Rydsater

Freelance Valuation Specialist

Verified Expert in Management Consulting

Sweden

Toptal Member Since April 26, 2018

Over his 16+ years as a professional, Olov has conducted 34 M&A engagements for corporate investors and 36 M&A engagements for financial investors, including private equity, investment companies, venture capital, and hedge funds. Olov has experience in M&A strategy, acquisitions, divestitures, fundraising, joint ventures, and M&A training. He has worked across many verticals in Europe, the US, and Asia.

Show MoreDavid Turney

Freelance Valuation Specialist

Verified Expert in Management Consulting

United States

Toptal Member Since September 26, 2017

As a seasoned valuation professional based in Denver, David brings nearly 20 years of experience in delivering high-impact valuation services to private equity, public company, and private company clients. Throughout his career, he's collaborated closely with senior management teams across both public and private companies, including many Fortune 500 companies. Freelancing allows David to leverage his skills and experience to assist clients with complex and unique projects.

Show MoreSven Brennecke

Freelance Valuation Specialist

Verified Expert in Management Consulting

Canada

Toptal Member Since September 17, 2022

Sven is a qualified valuation expert delivering services for market caps up to $250 million for state-owned entities, public companies, and privately held entities. Sven successfully bid for and subsequently was a team member for the privatizations of an O&G and a utility entity. Sven holds the CBV designation, is IVS trained for the IVSC standards, and has an MBA in finance. Sven enjoys working across cultures and providing his expertise to clients located around the globe.

Show MoreRogier Roumen

Freelance Valuation Specialist

Verified Expert in Management Consulting

Netherlands

Toptal Member Since October 31, 2018

Rogier is a seasoned finance expert who has worked for 100+ clients including startups such as Rocket Internet and corporations such as Heineken, Akzo Nobel, and Veon. He leverages his valuation, investment, FP&A, and accounting skills to solve pressing financial problems and enable actionable investment decisions. Freelancing gives him the flexibility to drive high-quality outcomes for clients across industries.

Show MoreJatin Detwani

Freelance Valuation Specialist

Verified Expert in Management Consulting

Singapore

Toptal Member Since July 27, 2022

Jatin is the winner of Asia's Greatest CFO award for his work as the APAC CFO of Rocket Internet, one of the world's largest incubators and investors in technology companies. During his 20+ years of experience, he has advised 100+ fast-growing companies as a co-founder, CFO, board member, and advisor worldwide. His experience is multi-fold and multi-dimension. Jatin considers various perspectives when leading projects, including investors, co-founders, shareholders, and customers.

Show MoreMark Tan

Freelance Valuation Specialist

Verified Expert in Management Consulting

Singapore

Toptal Member Since April 16, 2019

Mark has 10+ years of investment and finance experience at global transportation investor Buss Global Management, closing $4 billion of M&A and fundraising mandates. He has worked across industries covering the shipping, offshore/marine, property, hospitality, biotechnology, telecommunications, and media sectors. Mark leverages his buy and sell-side expertise to offer practical advice to companies across stages and industries.

Show MoreValentine Sabulis

Freelance Valuation Specialist

Verified Expert in Management Consulting

Australia

Toptal Member Since August 24, 2022

Val is a seasoned professional with broad experience working as a CFO and COO across various enterprises in Australia, the US, and the UK. He has held senior roles in finance, operations, technology, and product management in startups and established corporates. Having worked with over 100 newly formed and high-growth ventures, Val is now a full-time independent consultant specializing in startups.

Show MoreDiscover More Valuation Specialists in the Toptal Network

Start HiringA Hiring Guide

Guide to Hiring a Great Valuation Specialist

Valuation experts can tell you how much a business is worth and explain why. This guide to hiring a Business Valuation Specialist features interview questions and answers, as well as best practices that will help you identify the best candidates for your company.

Read Hiring GuideToptal in the press

... allows corporations to quickly assemble teams that have the right skills for specific projects.

Despite accelerating demand for coders, Toptal prides itself on almost Ivy League-level vetting.

Our clients

Creating an app for the game

Leading a digital transformation

Building a cross-platform app to be used worldwide

Drilling into real-time data creates an industry game changer

Testimonials

How to Hire Valuation Experts Through Toptal

1

Talk to One of Our Client Advisors

A Toptal client advisor will work with you to understand your goals, technical needs, and team dynamics.

2

Work With Hand-selected Talent

Within days, we’ll introduce you to the right valuation advisor for your project. Average time to match is under 24 hours.

3

The Right Fit, Guaranteed

Work with your new valuation analyst for a trial period (pay only if satisfied), ensuring they’re the right fit before starting the engagement.

EXCEPTIONAL TALENT

How We Source the Top 3% of Valuation Specialists

Our name “Toptal” comes from Top Talent—meaning we constantly strive to find and work with the best from around the world. Our rigorous screening process identifies experts in their domains who have passion and drive.

Of the thousands of applications Toptal sees each month, typically fewer than 3% are accepted.

FAQs

Valuation is the process of calculating a value at which willing and unrelated parties (free from undue duress) would likely buy and sell a business under normal operating conditions.

Business valuation determines how much a company (or part of a company) is worth. This is important information to have when you’re buying or selling a business, contemplating a partnership or dissolution, planning for estate purposes, gathering information for tax reporting, or seeking an accurate, unbiased assessment of a fair price for your company. Typically, you’ll need an impartial outside expert to determine this.

Whether you’re hiring a valuation professional online or in person, what’s most important is their history of work in valuation and their experience in the industry under consideration. But you’ll also want to note how they present their experience online, since clear, persuasive written and graphic communication skills are critical in this job.

If you’ve narrowed the field down to two candidates with otherwise comparable credentials, you may want to consider which one has greater experience in the specific kind of valuation that applies, such as M&A valuation or private business valuation. Another differentiating factor to look at is the candidates’ expertise in the industry of the company you want to have valued.

Mergers and acquisitions require company valuations to help the parties agree on a sales price for the business being acquired. Having reliable independent valuations can also aid the business leaders as they make decisions pertaining to the M&A, both before and after the process is complete.

Each approach is used to arrive at the value of the business. But while there isn’t any formal or legal definition of—or differentiation between—the terms, they’re used differently. Typically, an appraisal tends to be less rigorous than a valuation.

We make sure that each engagement between you and your valuation specialist begins with a trial period of up to two weeks. This means that you have time to confirm the engagement will be successful. If you’re completely satisfied with the results, we’ll bill you for the time and continue the engagement for as long as you’d like. If you’re not completely satisfied, you won’t be billed. From there, we can either part ways, or we can provide you with another valuation specialist who may be a better fit and with whom we will begin a second, no-risk trial.

To hire the right valuation specialist, it’s important to evaluate a candidate’s experience, technical skills, and communication skills. You’ll also want to consider the fit with your particular industry, company, and project. Toptal’s rigorous screening process ensures that every member of our network has excellent experience and skills, and our team will match you with the perfect valuation specialists for your project.

You can hire valuation analysts on an hourly, part-time, or full-time basis. Toptal can also manage the entire project from end-to-end with our Managed Delivery offering. Whether you hire a valuation specialist for a full- or part-time position, you’ll have the control and flexibility to scale your team up or down as your needs evolve. Our valuation specialists can fully integrate into your existing team for a seamless working experience.

At Toptal, we thoroughly screen our valuation experts to ensure we only match you with the highest caliber of talent. Of the more than 200,000 people who apply to join the Toptal network each year, fewer than 3% make the cut.

In addition to screening for industry-leading expertise, we also assess candidates’ language and interpersonal skills to ensure that you have a smooth working relationship.

When you hire valuation advisors with Toptal, you’ll always work with world-class, custom-matched valuation specialists ready to help you achieve your goals.

Typically, you can hire valuation specialists with Toptal in about 48 hours. For larger teams of talent or Managed Delivery, timelines may vary. Our talent matchers are highly skilled in the same fields they’re matching in—they’re not recruiters or HR reps. They’ll work with you to understand your goals, technical needs, and team dynamics, and match you with ideal candidates from our vetted global talent network.

Once you select your valuation analyst, you’ll have a no-risk trial period to ensure they’re the perfect fit. Our matching process has a 98% trial-to-hire rate, so you can rest assured that you’re getting the best fit every time.

Explore Related Toptal Services

Looking for an end-to-end business solution? Browse Toptal's portfolio of services.

How to Hire Business Valuation Specialists

As M&A Ramps Up Again, Companies Need Good Business Valuation Specialists

Since the slowdown of the early pandemic, demand has been growing for talented business valuation professionals. More than 60% of 800 business owners interviewed for the 2022 MassMutual Business Owner Perspectives Study said that knowing the value of their business was important. “Measuring business health” was the primary reason, but there are many situations in which a company needs a definitive and defensible figure—for example, when the business is up for sale. In 2022, M&A was almost back to pre-pandemic levels, according to The 2022 M&A Report from Boston Consulting Group. Robust demand for business valuation specialists will likely continue throughout 2023 and beyond.

Valuing a business accurately isn’t a job for novices. Unlike real estate deals, business valuations and transactions aren’t published in a public database or otherwise readily accessible. It takes experience to know which of the widely varying techniques and methodologies to use—why the special valuation approaches appropriate for a fintech startup may not be right for more established businesses, for example.

Not only is business valuation a specialized skill, but for most use cases, regulations and stakeholders require that the analysis be conducted—and the report published—by a neutral third party in order to avoid conflicts of interest. This means you must hire a valuation expert from outside your company—whether it’s through a specialized investment bank, a public accounting agency, or a valuation agency—or hire an independent contractor.

This hiring guide offers insights into how to hire the best business valuation consultant for your particular needs.

What distinguishes quality Business Valuation Specialists from others?

When you’re looking for a quality business valuation professional, experience should be your primary criterion. Ideally, your candidate will have a minimum of 10 years of experience in conducting business valuations generally, as well as specialized sector experience relevant to your use case. For instance, if the valuation is being used for tax purposes, it will be subject to extensive scrutiny and liability, so you should hire someone who knows how to handle those tax-specific requirements. If you’d like an indicative valuation, to understand your business’s present worth, someone with fewer than 10 years of experience may be acceptable. It’s not advisable to hire a business valuation specialist with less than five years of experience.

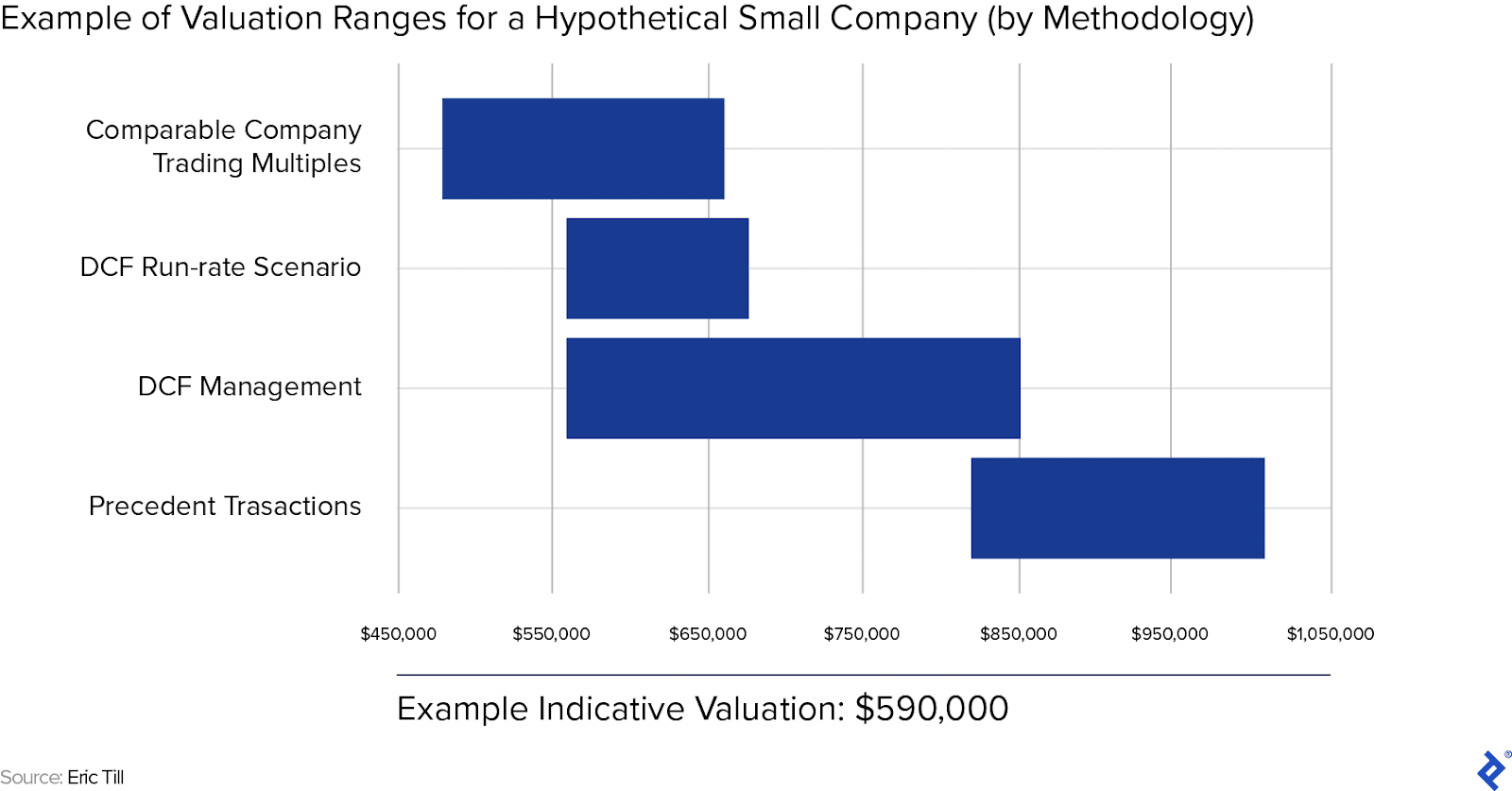

A business valuation analyst uses a variety of data sources and business valuation methods to arrive at a value or range of values that a business would likely command in a transaction between willing parties operating in a normal business environment—in essence, its fair market value. While there are a variety of approaches and methodologies to determine an accurate business valuation, some of the most frequently used include discounted cash flow (DCF) analysis, which assesses value based on the company’s future cash flow as projected in different ways; comparable company trading/valuation multiples (comparable company or comps) analysis, which compares the company to others of similar size in the same industry; and precedent transaction valuation (precedent transactions) analysis, which considers prices paid for similar companies to arrive at a valuation. Depending on the methodology, the results can vary. Knowing which approach is most appropriate is a matter of skill and experience, particularly in fluctuating market conditions and in alignment with current market trends.

While you may see a variety of valuation certifications when researching candidates—such as ABV, CBA, CSC, and CVA, among others—a business valuation analyst doesn’t need a specific valuation certification in order to be good at their job. That said, CFA (chartered financial analyst) is a significant qualification. Globally recognized, the CFA is a general credential for investment professionals that evaluates valuation and financial analysis abilities, among other skills. Certification requires a rigorous three-part exam, as well as years of experience in the field.

How can you identify the ideal Business Valuation Specialist for your project?

Your business valuation professional should possess a mix of hard and soft skills to best determine a company’s intrinsic value. These include:

- Strong data collection and analysis expertise.

- Deep knowledge of business-specific needs, use cases, and stakeholders. Professionals offering valuation services should also be capable of translating complex analysis into strategic insights for executive-level decision-making.

- Sector-specific experience relevant to your use case, including industry-related techniques and expectations.

-

Skills in analyzing, quantifying, and qualifying business-specific risks; a business valuation specialist must understand how to work with risk, as it affects the potential value of the business. This includes assessing potential impairment losses, especially when projecting long-term financial performance.

- Critical thinking and facility with writing.

- Ability to communicate effectively with company management.

In addition to these valuation skills, the following may be relevant:

- General knowledge of accounting and tax principles – Most candidates are likely to have relevant financial experience and credentials. If they don’t, it’s a good idea to check their knowledge of basic accounting and tax principles.

- Experience with analyzing and adjusting profit margins – Profit margins are a major driver in valuations, so knowledge of how to calculate and interpret them can be useful. Experience with assessing asset impairment or negotiating with a lender may also be critical, depending on the project scope.

Finally, if your use case pertains to any of the following areas, be sure the business valuation analyst has significant experience (at least five years) with that specialty, as all three are subject to regulations and/or a high level of scrutiny:

- Compliance and other legal matters

- Tax reporting

- VC fundraising

How to Write a Business Valuation Specialist Job Description for Your Project

First, clearly describe your use case and business sector, including the stage in a negotiation when the valuation will be used. This will help candidates with relevant experience self-select, based on their experience, as well as give them a clearer sense of the nature of the project.

Next, list the data sources and financial documents you think the valuation specialist may need. You need not have these materials on hand, but think about the steps to acquire them and at what point in the data collection process you’ll want the business valuation expert to step in. Clearly state whether the role will involve ongoing financial reporting or contribute to broader consulting services. Including information about the scope, intensity, and length of the work you need performed will help both you and potential candidates understand what realistic project deadlines and budgets might look like.

Finally, be clear about your expectations in terms of qualifications and experience, bearing in mind the aforementioned guidance about special cases that require advanced expertise. Be specific about what you need.

What are the most important questions to ask when interviewing Business Valuation Specialists?

By the interview stage, you’ll have had the opportunity to look at the candidates’ education and prior positions, and you can then delve into their experience and how it applies to your particular use case.

How should this use case be approached?

It’s important to understand how the interviewee would calculate your valuation, especially if you’re in a niche market. If your company is a fintech or a startup, for example, inquire about their experience with fintech valuations or startup valuations. Or if you’re looking to buy a software company, be sure your analyst understands how to value intangible assets. While you may not be familiar with all valuation techniques, the candidate should be able to explain what approach they think is best for your case and why.

Will this valuation require additional information or data beyond what’s provided?

The answer to this question will help you assess how well the candidate understands your use case, as well as give you a sense of whether the time and money you have budgeted for the project are likely to be on target.

What steps do you follow in your workflow?

Regardless of use case or methodology, a business valuation specialist will generally follow a workflow such as this:

Step 1: Define objectives, stakeholders, resources, and methods.

- Understand why you need a business valuation, what data is available, and what specific challenges might arise.

- Choose methods and data sources based on the valuation objectives and stakeholders.

Step 2: Gather data.

- Compile information about the business, including a business operations overview.

- Aggregate historical business financials, and develop a financial model and financial projections.

- Adjust the model and projections, and define sensitivities and scenarios, incorporating risk in conjunction with business management. (Financial statements prepared for tax purposes and audited financials must be interpreted properly and reclassified as appropriate for business valuation use cases.)

Step 3: Research and analyze data.

- Perform in-depth analysis of company documents, audited financial statements or tax returns, business operational information, intangible assets, macro and business-specific risk factors, and other data.

- Research macro and industry- and business-specific economic factors, industry trends, and risk factors.

- Analyze public and private comparable industry transactions and trading multiples.

Step 4: Produce a valuation report.

- Design a comprehensive presentation of specific business risk factors.

- Draft a detailed company description and establish market positioning.

- Generate an industry-specific review and assessment of prevailing economic conditions and trends. Include evaluations of commercial real estate holdings, if relevant, and incorporate expected market conditions into the analysis.

- Create detailed historical and projected financial statements in line with business valuation standards.

- Contemplate, underwrite, and execute industry-specific valuation methodologies, utilizing best practices for accurate valuation determination. (No two companies are identical, and each business will have a unique scenario and stakeholders.)

- Validate all assumptions and results.

- Arrive at a customized, comprehensive, and defensible business valuation.

Step 5: Present and review the preliminary report with management.

- Present the preliminary business valuation report to enable a thorough understanding of its conclusions, verify accuracy, and ensure the report fulfills its objectives.

- Revise the preliminary draft, if needed, and issue the final report with customary disclaimers, representations, and warranties.

What will the deliverables look like?

The candidate should respond that the final report will include a business overview, market positioning, and industry and macrodynamic reviews, as well as supporting documents to validate and justify their results. They should also demonstrate how their valuation aligns with fair value principles and supports accurate financial reporting. If you would like the report to include specific information or formatting, request it. Also, ask how the candidate would defend their conclusions if challenged.

Can you describe how you worked through the last similar business valuation?

Ask how recently this valuation was performed. Expect each candidate to detail how they approached the case and note how nuanced their approach seems. The more recent and robust their experience with your kind of use case, the better.

Why do companies hire Business Valuation Specialists?

There are many reasons you may need a thorough, accurate, data-based business valuation of your company. Besides a potential sale, reasons may include partnership buyouts, estate and gift taxes, buy-sell agreements, divorce, corporate litigation, SBA loan applications, raising equity or debt capital, succession planning, stock options/employee stock/ESOP, incentive programs, fairness opinions, tax allocation and tax reporting, and valuing intangible assets. For any of these use cases, hiring a qualified business valuation specialist will demonstrate due diligence and reduce the likelihood of problems resulting from an incorrect or unsupported valuation during or after a transaction. Engaging a consultant who offers comprehensive valuation and advisory services ensures better alignment with your broader strategic goals.

No matter what size your business is or what industry you’re in, you’ll probably need to hire a business valuation specialist at some point. Being able to describe the nature and scope of your job will help you identify the specialist with the appropriate skills. Hiring the best specialist for your needs will, in turn, make the valuation process go as smoothly as possible.

Featured Toptal Valuations Publications

How to Build a 3-statement Model: Best Practices for Valuations and Projections

By Abdullah Karayumak, CFA

Valuation Ratios: The Key Metrics Management Consultants Need to Know

By Elizabeth J. Howell Hanano, CFA

Top Valuation Specialists Are in High Demand.